We help families across America handle funeral costs;

let us help yours too.

Who We Are

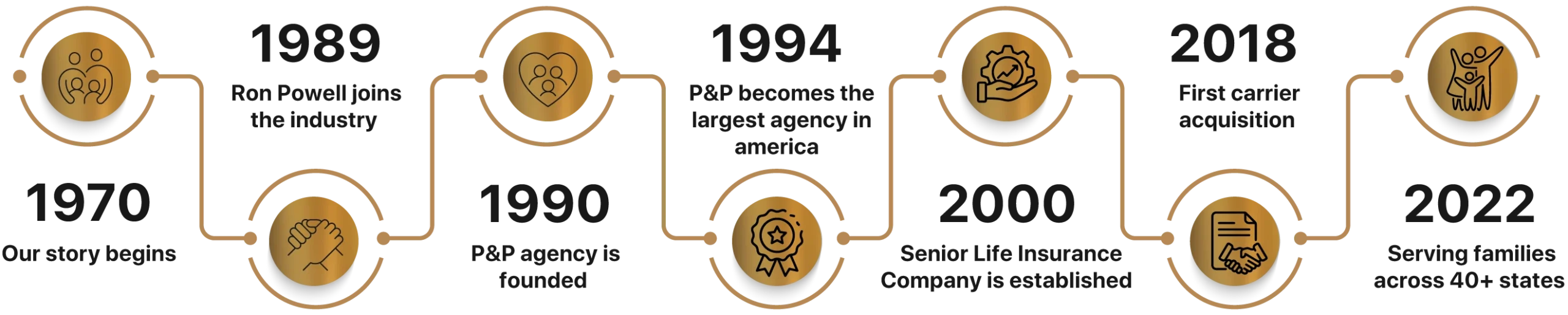

Our founder, Ron Powell, started his journey at 19 and quickly grew the company into a leader in final expense insurance and burial insurance.

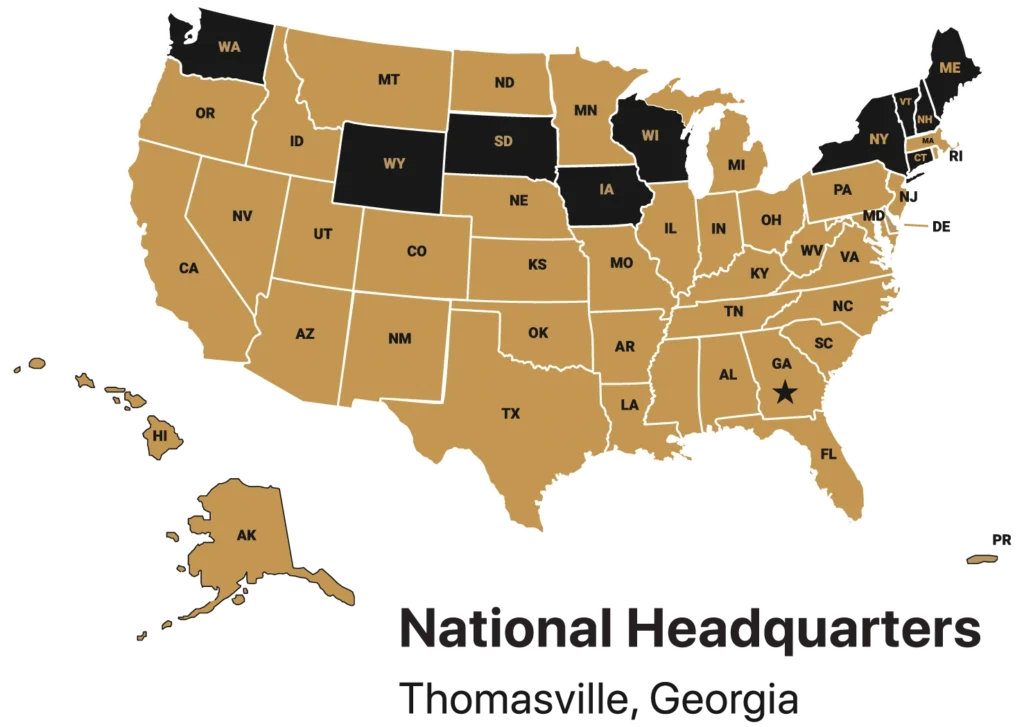

Today, we serve families across 40 states and Washington, D.C., with the same dedication, providing peace of mind and financial security.

Senior Life Insurance Company, founded in 1970, helps families protect their loved ones from the average funeral cost and high expenses of final arrangements.

With decades of experience, we’ve been providing affordable life insurance coverage tailored to seniors’ needs and funeral planning goals.

Protecting

Your Future

Is Our Mission

We provide affordable and reliable coverage that protects your family from the cost of final expenses, including cremation costs and burial plots.

How We Do It

Affordable Payments

Are Offered

We Prioritize

Your Claims

Your Claims Are

Our Top Priority

We Guarantee

Coverage For All

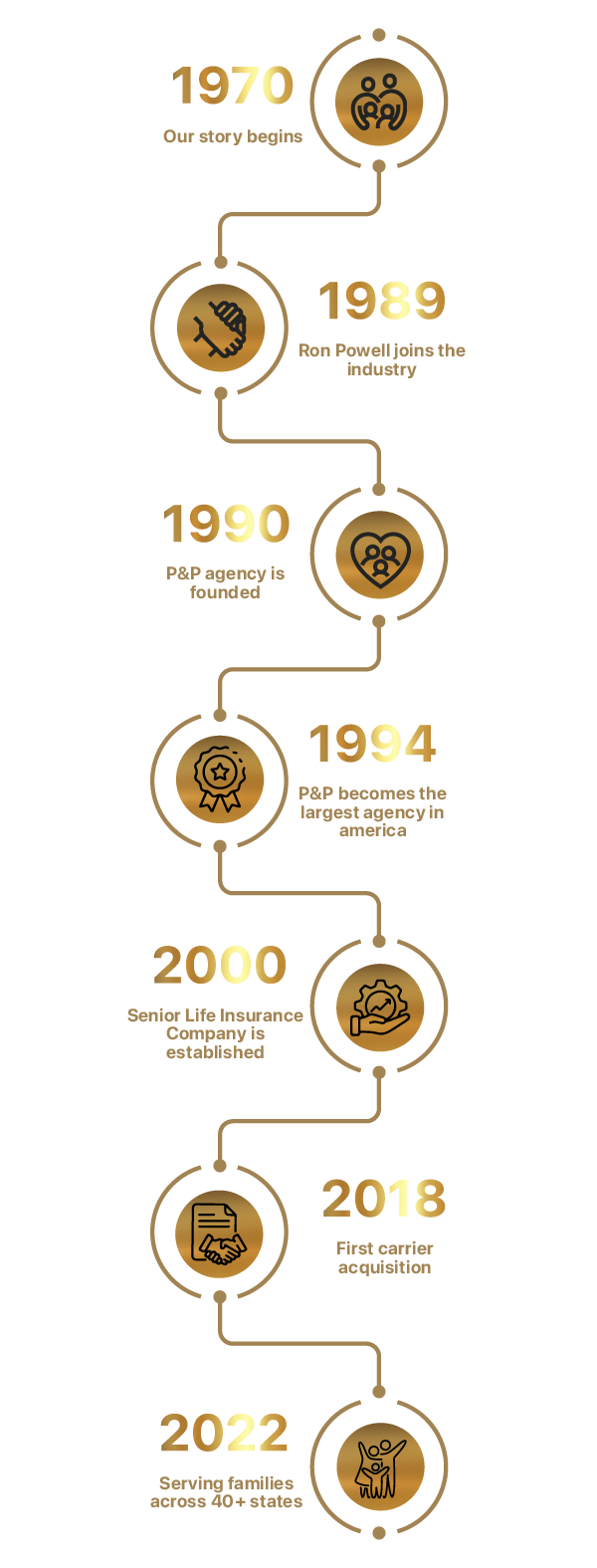

The Senior Life Journey

Our journey has always been about making a meaningful difference in the lives of our policyholders by securing their final wishes.

Our Values

Focus

Focus

Adaptability

Adaptability

Integrity

Integrity

Leadership

Leadership

Ron Powell

CEO and President

“At Senior Life, we greatly value family and pride ourselves in operating as one. Let us help you take care of your family at a time when they will need it most.”

Frequently Asked Questions

Can I increase my coverage?

Yes. You can add additional coverage at any age up to 85 years old. The maximum amount available is $50,000. Issuance may depend on your answers to some health-related questions.

Why do I need life insurance?

Life insurance will provide a death benefit that your selected beneficiary or beneficiaries can use for whatever they wish.

How much will life insurance cost me?

Life insurance premiums are usually based on factors such as age, gender, height, weight, and health status, including tobacco/nicotine use. The type of policy you purchase will also affect the premium amount. Contact us at (877) 777-8808 to get a premium quote.

What is a beneficiary?

A beneficiary is a person or entity designated to receive the life insurance proceeds upon the death of the insured. The beneficiary is designated when the policy is purchased and can be changed at the policyholder’s request.

Get In Touch

Our Home Office staff is always here to assist you!

![]() Mon – Fri:

Mon – Fri:

![]() 8:30 am – 5:00 pm

8:30 am – 5:00 pm

OR Toll Free +1 (877) 777-8808

Or you can fill out the form here, and a representative will follow up shortly. We look forward to serving you.